Apple announced financial results for its fiscal 2023 fourth quarter ended September 30, 2023 on Thursday. Apple posted quarterly sales of $89.5 billion, down 1 percent year over year, and quarterly earnings per diluted share of $1.46, up 13 percent year over year. These numbers were better than the analysts expected but still yielded the 4th quarter of declining revenue for Apple. During the conference call after the announcement Apple mentioned that the strong US dollar has had a negative impact on the results and if we were talking about constant dollars the company’s sales grew. But we do not live in that alternative reality so the decline is real.

Tim Cook said “Today Apple is pleased to report a September quarter revenue record for iPhone and an all-time revenue record in Services. We now have our strongest lineup of products ever heading into the holiday season, including the iPhone 15 lineup and our first carbon-neutral Apple Watch models, a major milestone in our efforts to make all Apple products carbon neutral by 2030.”

Luca Maestri, Apple’s CFO added “Our active installed base of devices has again reached a new all-time high across all products and all geographic segments, thanks to the strength of our ecosystem and unparalleled customer loyalty, During the September quarter, our business performance drove double-digit EPS growth and we returned nearly $25 billion to our shareholders, while continuing to invest in our long-term growth plans.”

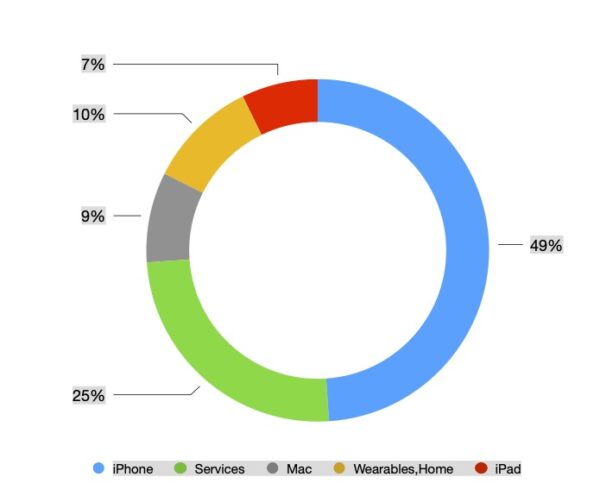

The Mac continues to take a hit with the worst decline in sales. Some of that may be that fewer people find the need for a computer now that iPhones and iPads are so ubiquitous. Mac sales significantly lower in Q4 2023, with Macs bringing in $7.6 billion, down 34 percent vs $11.5 billion in the year-ago quarter. Mac revenue for all of 2023 was $29.4 billion, down from $40.2 billion in 2022. Tim Cook expects Mac revenue to improve next quarter thanks to the October introduction of the M3 Macs, and he said that the negative 34 percent growth should not be seen as representative of the underlying performance of the Mac.

iPhone revenue was up during the quarter setting a September quarter record, coming in at $43.8 billion, up from $42.6 billion in the year-ago quarter. iPhone revenue was down for the year, though, at $200.6 billion, down from $205.5 billion last year.Apparenlty, the iPhone 15 models sold better than the iPhone 14 models, but supplies of the iPhone 15 Pro and Pro Max were constrained, which impacted Apple’s total iPhone revenue.iPhone revenue is expected to grow year-over-year in the December quarter.

Services continued to shine with a new all-time revenue record. Services revenue was $22.3 billion, up 16 percent from $19.2 billion in the year-ago quarter. iCloud, Apple Care, Apple Music, Advertising and the App store all hit revenue records in the quarter.

iPad was down a bit but not as bad as Mac sales and wearables also dropped slightly.

Apple now has $162.1 billion in cash on hand vs. $166.5 billion at the end of Q323.

Apple’s board of directors has declared a cash dividend of $0.24 per share of the Company’s common stock. The dividend is payable on November 16, 2023 to shareholders of record as of the close of business on November 13, 2023. While not the double-digit growth that Apple has been known for over the years, this quarter’s results are a very strong indication of Apple’s inherent strength. Congratulations to the entire Apple team!