Apple Posts Profits Before Tariffs

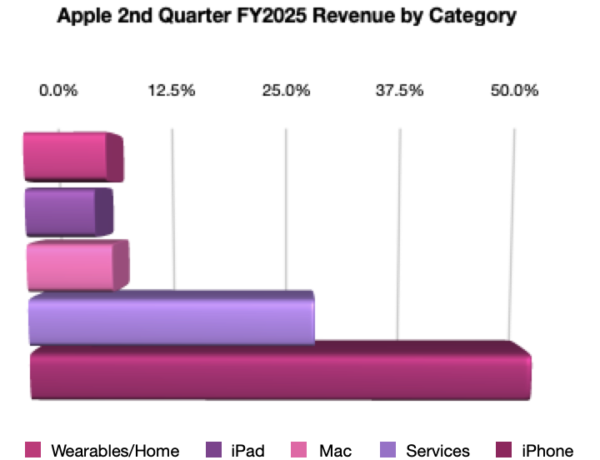

Apple reported their 2nd quarter earnings after the market closed on Thursday and once again Apple beat the street posting excellent results with $95.4 billion in revenue for the 3-month period ending on March 31st. This represents a 5% increase in revenue year-over- year and about a $1 billion more than the analysts expected.

iPhone, Mac, iPad and Services all reported revenue increases for the quarter while wearables had a modest decline from $7.9 billion to $7.5 billion. Services with a profit margin north of 70% reported $26.6 billion for the quarter which is an all-time high.

Apple’s board of directors declared an increased $0.26 dividend payable to stockholders as of May 12th. They also authorized another $100 billion for share repurchases.

Tim Cook said:

“Today Apple is reporting strong quarterly results, including double-digit growth in Services. We were happy to welcome iPhone 16e to our lineup, and to introduce powerful new Macs and iPads that take advantage of the extraordinary capabilities of Apple silicon. And we were proud to announce that we’ve cut our carbon emissions by 60 percent over the past decade.”

The tariffs were a big topic of conversation however, did not impact the Q2 earnings which mostly happened before the tariffs took effect. Nevertheless, It appears that iPhone purchasing pre-tariffs did not see a huge jump. Tim Cook made it clear that Apple is diversifying its sourcing and indicated that most of the Apple products coming to the USA would be from India and Vietnam as opposed to normal sources in China.

Tim also indicated, however, that he saw about a $900 million hit to Apple from the tariffs. Apple acknowledged the uncertainty not only of the tariffs but also the relative strength of the dollar. As with every quarter since the pandemic, Apple did not provide guidance for Q3.

All in all, given the economic uncertainty caused by the Trump tariffs, Apple posted amazing numbers and deserve congratulations on a very successful 2nd quarter of FY2025. Of course, the stock went down.