Blood Oxygen Monitoring Returns to Recent US Apple Watches with Software Updates

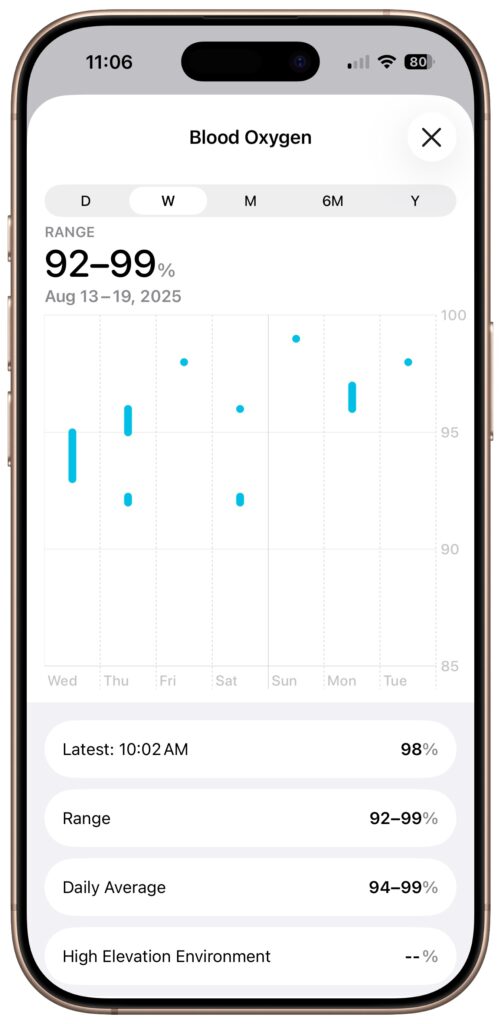

With the release of iOS 18.6.1 and watchOS 11.6.1, Apple restored blood oxygen monitoring capabilities to US Apple Watch Series 9, Series 10, and Ultra 2 models that previously had this feature disabled due to a patent infringement suit by medical device maker Masimo. Apple’s redesign processes blood oxygen data on the paired iPhone rather than on the watch itself. After updating both devices, you can view your blood oxygen readings in the Health app under Browse > Respiratory > Blood Oxygen. If blood oxygen monitoring doesn’t activate immediately after updating, try opening the ECG app on your watch to trigger the necessary software asset download. Apple Watch units that predate the ban and those sold in other countries continue to work as they always have, with the Blood Oxygen app on the watch itself.

(Featured image by Adam Engst)

Social Media: Apple restored blood oxygen monitoring on recent US Apple Watch models through a creative workaround that processes and displays data on the iPhone instead of the watch. Here’s how to get it working again.